Protect Your Home and Assets With Comprehensive Home Insurance Coverage Insurance Coverage

Comprehending Home Insurance Policy Insurance Coverage

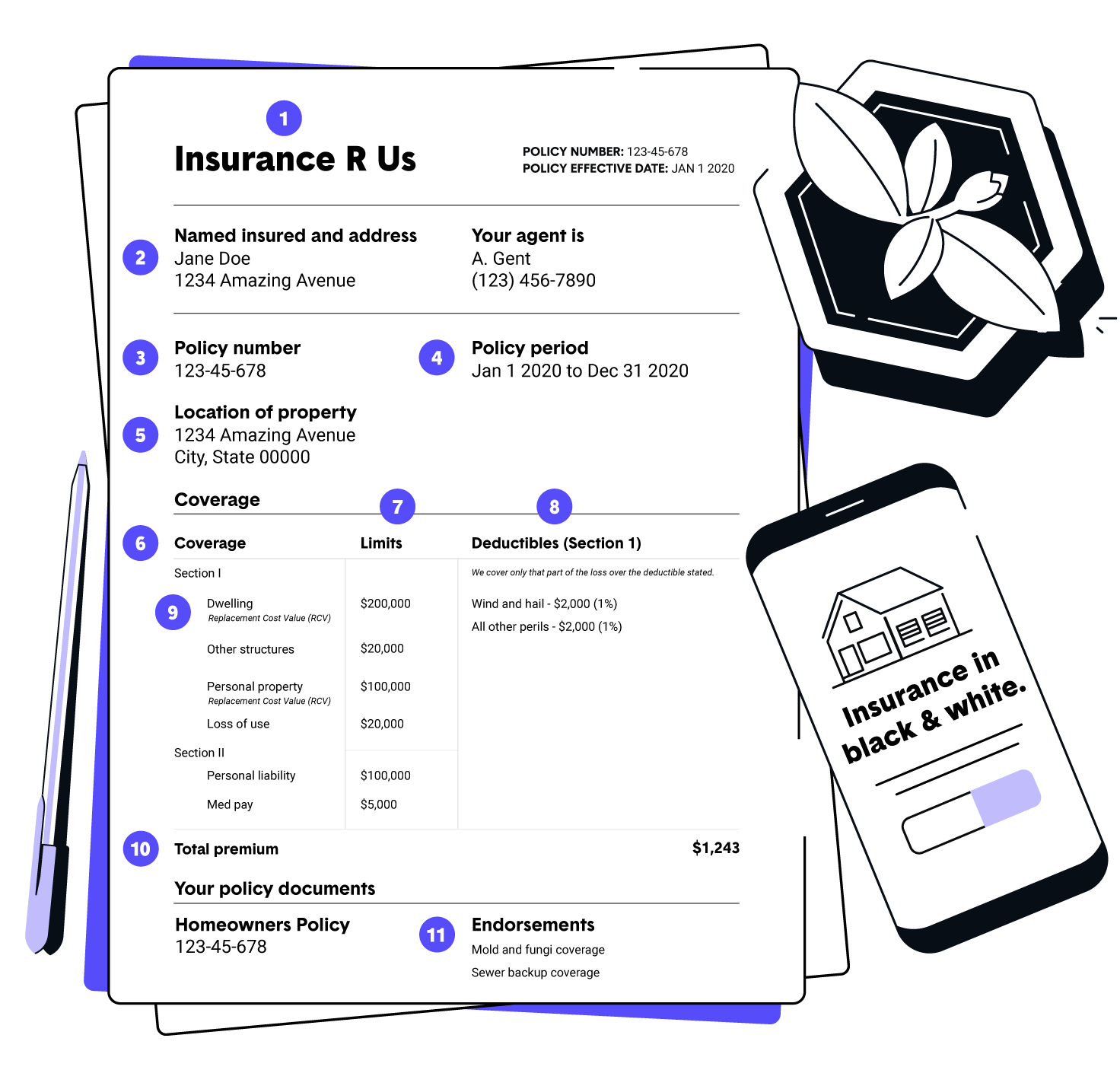

Recognizing Home Insurance policy Insurance coverage is vital for home owners to shield their building and assets in case of unanticipated events. Home insurance coverage usually covers damage to the physical structure of the house, personal possessions, liability defense, and extra living costs in the event of a covered loss - San Diego Home Insurance. It is important for house owners to comprehend the specifics of their policy, including what is covered and excluded, plan limitations, deductibles, and any added endorsements or cyclists that might be required based on their individual conditions

One trick element of recognizing home insurance coverage is knowing the difference between actual money worth (ACV) and replacement expense insurance coverage. House owners should likewise be conscious of any kind of insurance coverage limits, such as for high-value items like precious jewelry or art work, and take into consideration purchasing added coverage if required.

Benefits of Comprehensive Policies

When discovering home insurance protection, property owners can gain a much deeper recognition for the security and peace of mind that comes with extensive policies. Comprehensive home insurance policy plans provide a wide range of benefits that go past basic insurance coverage.

Additionally, thorough plans typically consist of insurance coverage for liability, providing protection in case a person is harmed on the home and holds the house owner responsible. This liability coverage can aid cover clinical expenses and lawful costs, offering more assurance for home owners. Detailed plans might likewise offer added living expenses protection, which can aid pay for momentary housing and various other required costs if the home comes to be uninhabitable due to a protected occasion. On the whole, the thorough nature of these policies provides homeowners with durable security and financial security in different circumstances, making them a valuable financial investment for securing one's home and possessions.

Customizing Insurance Coverage to Your Needs

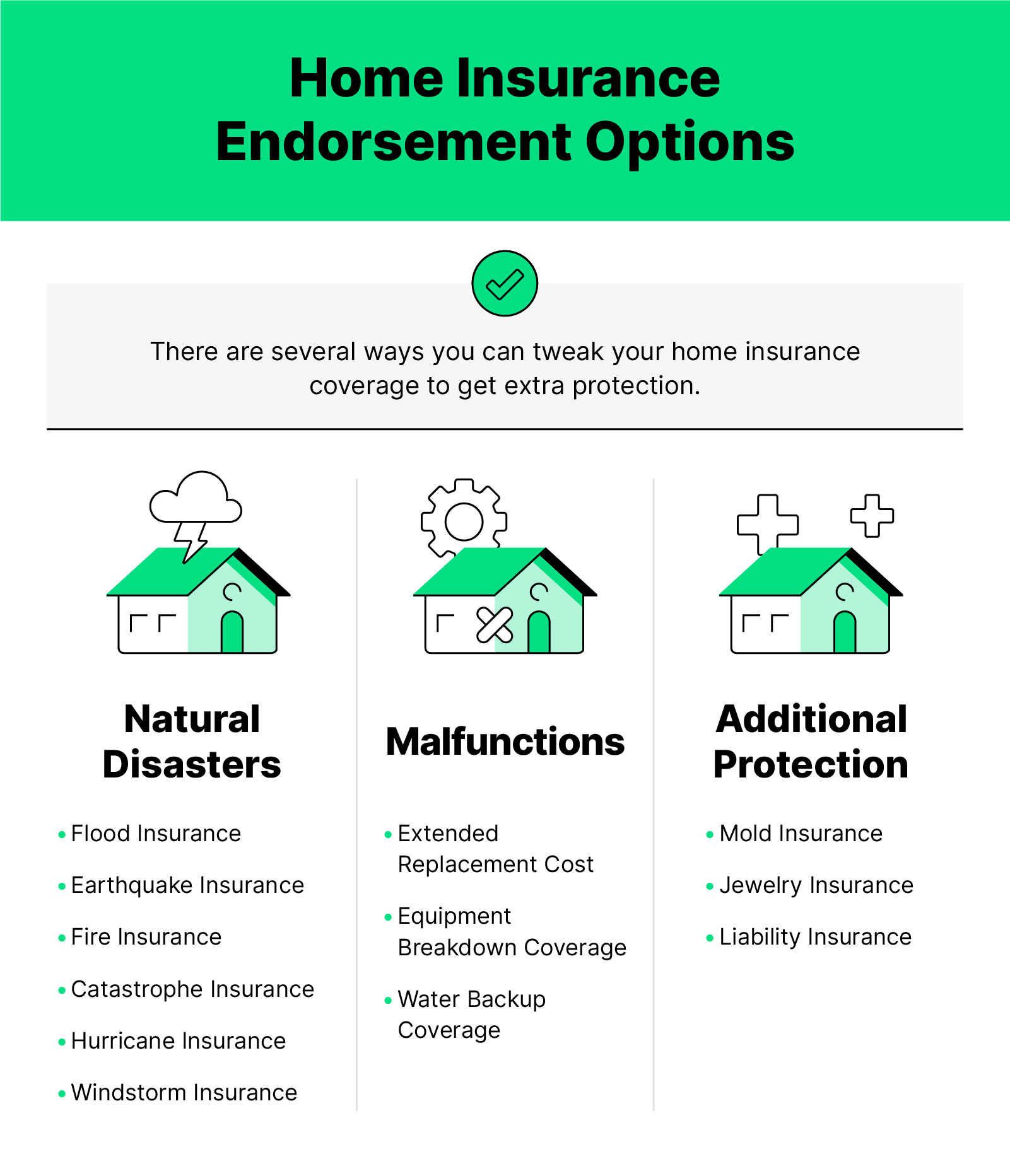

Customizing your home insurance coverage to straighten with your certain needs and situations makes sure a individualized and effective securing technique for your residential property and properties. Tailoring your protection allows you to deal with the one-of-a-kind aspects of your home and properties, providing an extra extensive guard against prospective dangers. By assessing variables such as the worth of your building, the contents within it, and any kind of extra frameworks on your facilities, you can determine the appropriate degree of protection needed to shield your investments appropriately. Furthermore, personalizing your plan enables you to add details endorsements or bikers to cover items that might not be consisted of in basic strategies, such as high-value precious jewelry, art collections, or home-based businesses. Recognizing your private demands and link functioning closely with your insurance policy company to tailor your protection ensures that you are adequately protected in the occasion of unexpected circumstances. Inevitably, customizing visit your home insurance protection supplies assurance recognizing that your possessions are secured according to your special situation (San Diego Home Insurance).

Securing High-Value Properties

To sufficiently protect high-value assets within your home, it is vital to examine their worth and think about specialized insurance coverage choices that deal with their distinct value and importance. High-value possessions such as art, precious jewelry, vintages, and antiques may surpass the insurance coverage limitations of a conventional home insurance plan. Therefore, it is critical to deal with your insurance policy service provider to guarantee these products are effectively shielded.

One method to safeguard high-value possessions is by arranging a separate plan or recommendation especially for these items. This specialized coverage can provide higher coverage limits and might likewise include extra protections such as insurance coverage for unintentional damage or mystical loss.

Additionally, prior to acquiring insurance coverage for high-value possessions, it is a good idea to have these products skillfully evaluated to develop their current market worth. This appraisal paperwork can assist enhance the insurance claims process in case of a loss and guarantee that you get the proper compensation to change or repair your beneficial belongings. By visit homepage taking these positive steps, you can enjoy tranquility of mind understanding that your high-value assets are well-protected against unexpected situations.

Cases Process and Policy Monitoring

Verdict

In verdict, it is important to guarantee your home and possessions are effectively shielded with extensive home insurance protection. It is vital to focus on the protection of your home and assets with comprehensive insurance policy coverage.

One trick aspect of comprehending home insurance coverage is knowing the distinction in between real money value (ACV) and replacement expense insurance coverage. House owners ought to likewise be aware of any insurance coverage restrictions, such as for high-value items like jewelry or art work, and consider purchasing additional coverage if necessary.When discovering home insurance policy coverage, house owners can get a much deeper admiration for the security and peace of mind that comes with detailed plans. High-value properties such as great art, jewelry, antiques, and collectibles may exceed the coverage limitations of a basic home insurance coverage plan.In final thought, it is necessary to guarantee your home and assets are properly secured with thorough home insurance protection.

Comments on “Some Of San Diego Home Insurance”